INP-WealthPk

Fakiha Tariq

Attock Refinery Limited (ATRL) reported the highest profit gain in the refinery sector during the first quarter (July-Sept) of fiscal year 2022-23 (1QFY23), with the company’s stock returns depicting a constructive mix of money made by the investors, according to a study conducted by WealthPK.

The ATRL remained the third largest company in terms of market cap in the refinery sector and showed a steady trading activity throughout the 1QFY23.

Pakistan’s refinery sector on the Pakistan Stock Exchange (PSX) is represented by four companies, including ATRL, Cnergyico PK limited (CNERGY), National Refinery Limited (NRL) and Pakistan Refinery Limited (PRL).

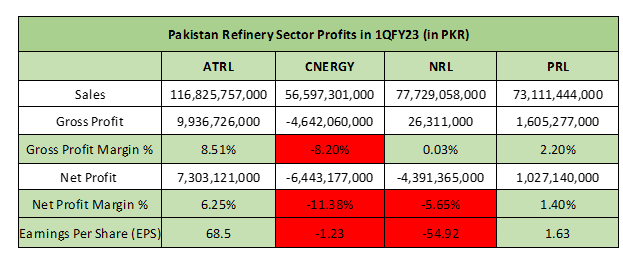

Profitability comparison of refinery sector in 1QFY23

The WealthPK study took gross profit margin, net profit margin and earnings per share (EPS) ratios as measures of profitability comparison.

Three out of the four companies in the refinery sector earned profits during 1QFY23, with ATRL leading the table with a gross profit of 8.51% and net profit of 6.25 % on the sales.

ATRL’s sales totalled Rs116 billion and earnings per share stood at Rs68.5.

PRL ranked second in terms of earning profits during 1QFY23. With the sales amounting to Rs73 billion, PRL earned 2.20% of gross profit and 1.40% of net profit margin. Its EPS for 1QFY23 remained at Rs1.63.

NRL ranked third in terms of sales revenue as its top line stood at Rs77 billion in the first quarter of FY23. However, its gross profit stood at only 0.03%. The NRL also reported a net loss of 5.65% and loss per share of Rs54.92.

Though being a top trading symbol on PSX, CNERGY has experienced a gross loss and net loss of 8.20% and 11.38%, respectively. Subsequently, it suffered a loss per share of Rs1.23.

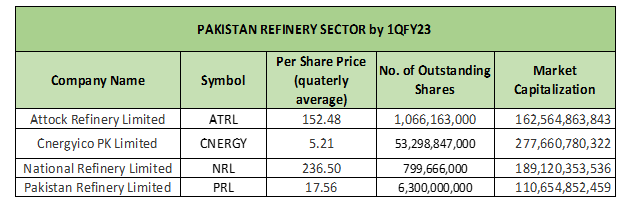

Company size – refinery sector 1QFY23

During the first quarter of FY23, CNERGY was reported as a leading symbol with a market cap of Rs277 billion followed by NRL with a market cap of Rs189 billion.

ATRL held the third spot with its market capitalisation standing at Rs162 billion. PRL was the fourth ranked with a market cap of Rs110 billion in 1QFY23.

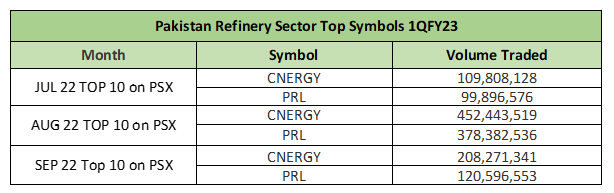

PSX top 10 – refinery sector 1QFY23

PSX lists most active stocks as top 10 symbols on a monthly basis. Out of its four listed symbols, CNERGY and PRL consistently made presence in the top 10 symbols chart during 1QFY23. Therefore, 50% of the refinery sector stocks experienced top trading activity on PSX.

The refinery sector was rated as the second most active sector on PSX from January 22 to October 22, 2022. CNERGY with traded volume of 452,443,519 shares in August-22 hit the highest traded volume in the refinery sector.

STOCK market returns – refinery sector 1QFY23

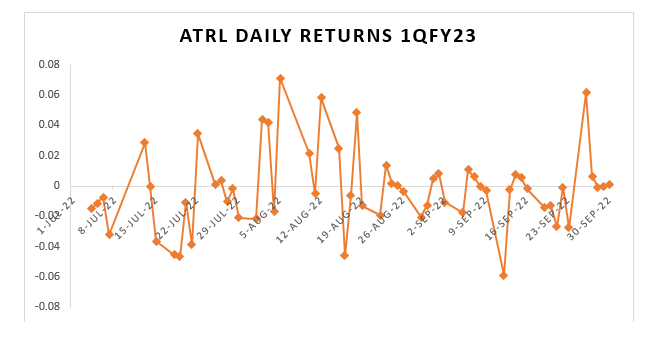

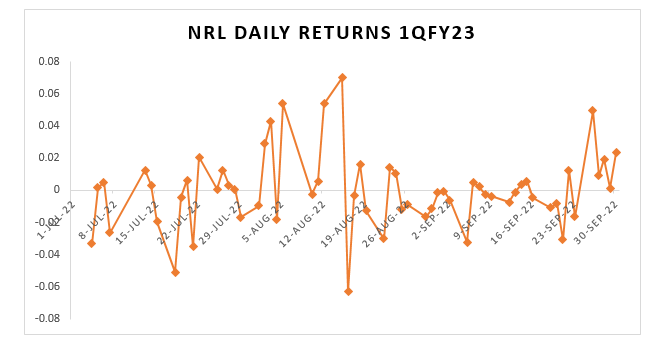

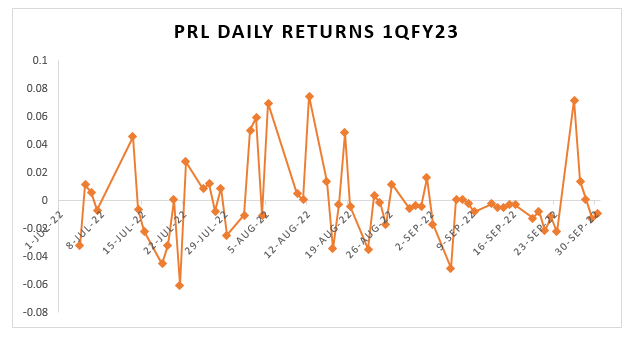

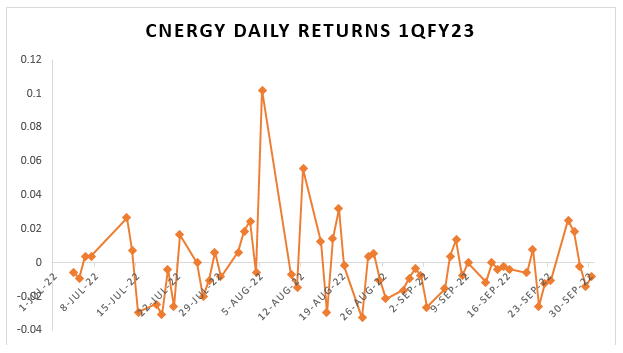

With multiple positive traces, stock return patterns of all the four refinery sector companies were nearly the same. Analysis of stock market returns helps investors devise investing strategies. Daily stock market returns for the first quarter of FY23 have been calculated and shown in graphs below.

ATRL: ATRL returns were the most favourable for 1QFY23. ATRL daily returns showed top spikes in the month of August.

NRL: For NRL, August-22 witnessed few positive gains, which was followed by low and negative returns. However, 1QFY23 ended in high returns

PRL: One of the top traded symbols, PRL stock returns showed multiple positive spikes in the first quarter of FY23.

CNERGY: Although CNERGY remained in gross and net loss during 1QFY23, it also showed top spikes of returns in the month of August 2022.

Credit : Independent News Pakistan-WealthPk