INP-WealthPk

Hifsa Raja

Prime Minister Shehbaz Sharif’s recent visit to Turkiye, where he elicited commitments to Turkish investments in different sectors, particularly energy, is sure to infuse positive feeling into the otherwise subdued stock market at home. In this regard, WealthPK spoke to Muhammad Latif, the Manager of KHS Securities.

WealthPK: What impact does Prime Minister Shahbaz Sharif’s trip to Turkiye have on the stock market?

Muhammad Latif: The PM’s trip to Turkiye will go a long way in strengthening the bilateral relations between the two countries and may also help the market in the long-run as the visit would potentially herald investment opportunities in Pakistan. The prime minister’s visit was crucial because he invited Turkish investors to make investments in different sectors, particularly solar power. The stock market will likely respond positively to this development.

WealthPK: What are the main sectors that Pakistan can benefit from Turkiye’s assistance?

Muhammad Latif: Pakistan can benefit from Turkiye’s assistance in solar energy and manufacturing. The two nations have also agreed to take their existing $1-$1.5-billion bilateral trade to $5 billion. Considering the trade potential between the two nations, the existing trade volume is very small. Pakistan’s economy can benefit from Turkish know-how in industrialisation and clean energy. The Turkish investors have been assured by the prime minister that their interests will be safeguarded if they fund solar energy projects in Pakistan.

WealthPK: Do you think the PM’s Turkiye trip will bring investments to Pakistan?

Muhammad Latif: The two nations have signed a memorandum of understanding to increase bilateral trade volume to $5 billion over the next three years. The prime minister has also invited Turkish companies to invest in Pakistan during a meeting with the Pakistan-Turkey Business Council.

WealthPK: Will the decline in the current account deficit affect the growth rate in the ongoing financial year?

Muhammad Latif: The current account deficit significantly moderated in September and October of the ongoing financial year thanks to a sharp decline in imports. This will definitely affect the growth rate as exports are not growing at the pace they should be to trigger robust growth. Some of the imports disallowed also have a bearing on the export-oriented industries. In the long run, Pakistan will have to increase production and find import substitution to not only keep the CAD within reasonable limits, but also boost exports for a sustainable growth.

WealthPK: What was the pattern of international purchases during the week when the prime minister was in Turkiye inviting Turkish investors to invest in Pakistan?

Muhammad Latif: The week coinciding with the prime minister’s visit to Turkiye saw $1.11 million in foreign purchases, which was down from $2.06 million in net purchases the previous week.

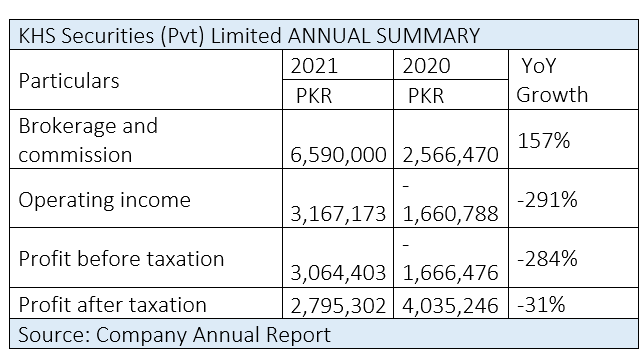

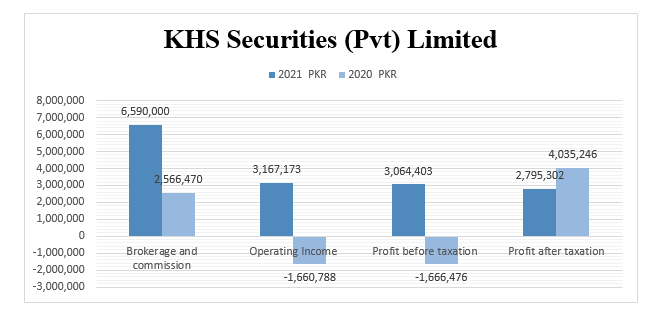

KHS Securities Financial Performance in FY21

KHS Securities Private Limited’s brokerage and commission fees increased 157% to Rs6.5 million in the financial year 2020-21 from Rs2.5 million over the corresponding period of FY20.

The operating income, showing a growth of 291%, stood at Rs3.16 million in FY21 compared to Rs1.66 million loss in FY20. The before-tax profit grew 284% and reached Rs3.06 million in FY21. The after-tax profit, however, decreased to Rs2.79 million in FY21 from Rs4.03 million in FY20, showing a decline of 31% year-on-year.

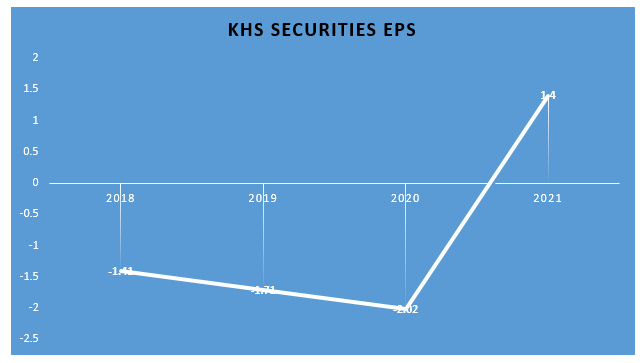

Earnings per share

The KHS Securities’ EPS remained negative from 2018 to 2020 before turning positive and jumping to Rs1.4 in 2021.

Credit : Independent News Pakistan-WealthPk