آئی این پی ویلتھ پی کے

Ayesha Mudassar

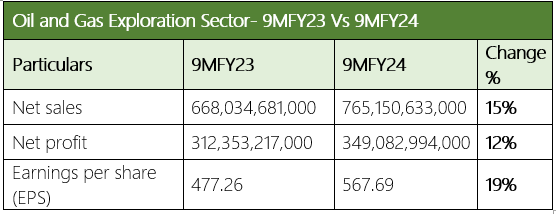

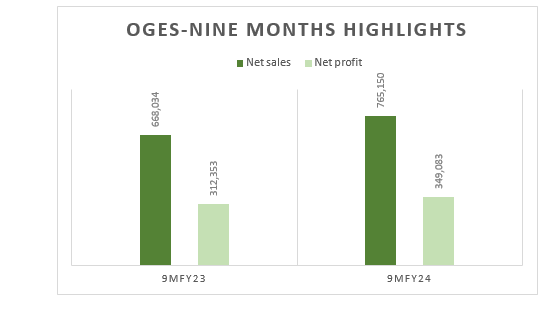

Pakistan's oil and gas exploration sector reported an upsurge of 15% in net sales, 12% in net profit, and 19% in earnings per share over the nine months (July-March) of FY2023-24 compared to the same period of the last fiscal, WealthPK reports. The stellar financial performance was largely boosted by enhanced hydrocarbon sales and higher sales prices during the period. During 9MFY24, the listed oil and gas firms collectively posted a net revenue of Rs765.1 billion, net profit of Rs349 billion, and earnings per share of Rs567.69. The growth in sales successfully overcame the rise in the sector’s expenditures related to taxes, royalties, other charges, and operation costs.

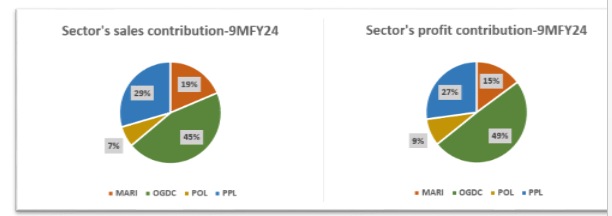

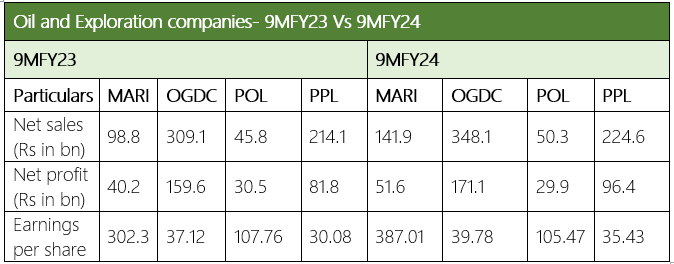

The Oil and Gas Development Company Limited (OGDC) made the highest contribution of 45% to the total revenue secured by the sector followed by the Pakistan Petroleum Limited (PPL) with a sales contribution of 29% in 9MFY24. Mari Petroleum Company Limited (MARI) with a share of 19% and Pakistan Oilfields Limited (POL) with a share of 7% stood third and fourth in the sector’s total sales.

In terms of net profit, the OGDC topped again by earning 49% of the total net profit. PPL and MARI added 27% and 15%, respectively, to the sector’s aggregated net profit in 9MFY24. The POL made the lowest contribution of 9% to the net profit. Oil and exploration companies: Inter-firm Comparison-9MFY24 OGDC, the country's leading state-owned oil and gas firm, posted a 13% increase in revenue, 7% in net profit, and 7% in earnings per share during 9MFY24, compared to the corresponding period of the previous fiscal year. The growth in the company's earnings was primarily due to the tax reversal of around Rs28 billion on account of a favourable verdict by the Supreme Court related to a depletion allowance. MARI’s revenue and net profit during 9MFY24 were up by 44% and 28%, respectively, due to higher prices, gas production, and currency depreciation.

PPL, the country's key gas supplier, reported an 18% rise in its net profit for the 9MFY24, driven by higher sales and lower exploration costs. Furthermore, the company's revenue for the period increased to Rs224.6 billion, compared to Rs214.1 billion during the same period a year earlier. During 9MFY24, the POL achieved a profit after tax of Rs29.9 billion and this could be attributed to numerous factors including increased sales value, higher interest income from increased deposits and interest rates, reduced exploration costs, and decreased finance cost.

Challenges faced

Despite notable achievements, the oil and exploration sector grapples with a series of challenges that have dampened its vibrant growth trajectory. The primary obstacles include regulatory hurdles, security concerns, and difficulties in repatriation of profits due to shortage of dollars. Owing to these impediments, several international players like the British Petroleum, ExxonMobil, and Eni have exited the Pakistan oil and gas sector.

Solutions for a brighter future

Improving security measures, streamlining the regulatory framework, and ensuring consistency in decision-making are strategic steps that must be taken to restore investor confidence. Furthermore, there is a need to learn from global giants like ARAMCO, ADNOC, and Petronas which have set exemplary benchmarks in enhancing production volumes, and adopting innovative technologies.

Credit: INP-WealthPk