INP-WealthPk

Jawad Ahmed

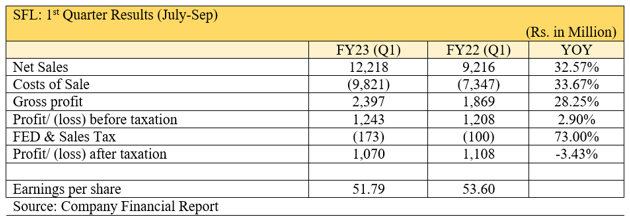

The net sales of Sapphire Fibres Mills Limited increased 32.57% to Rs12.21 billion in the first quarter (July-Sept) of the financial year 2022-23 (1QFY23) compared with Rs9.21 billion over the same period in the previous fiscal. However, due to an increase in the cost of sales and rising taxes, the company’s net profit declined marginally, reports WealthPK quoting the firm’s financial statistics. Sapphire Fibres Limited was incorporated in Pakistan on June 05, 1979, as a public limited company, which is principally engaged in the manufacturing and sale of yarn, fabrics and garments.

The firm’s gross profit increased to Rs2.39 billion in the first quarter of FY23 from Rs1.86 billion in the corresponding period of FY22. The company’s before-tax-profit slightly improved to Rs1.24 billion in 1QFY23 from Rs1.20 billion in 1QFY22. Owing to an increase in taxes, the after-tax earnings decreased by 3.43% to Rs1.07 billion in 1QFY23 from Rs1.10 billion in 1QFY22. As a result of a decline in profits, the earnings per share (EPS) dropped to Rs51.79 in 1QFY23 from Rs53.60 in 1QFY22.

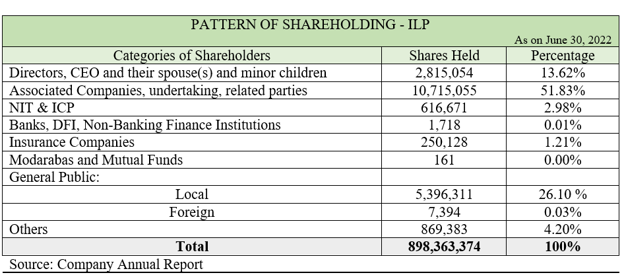

As of June 30, 2022, the company’s directors, the CEO, their spouses and minor children owned 13.62% of the shares; associated companies, undertakings and related parties had 51.83%, NIT & ICP 2.98%, local investors possessed 26.10% and ‘others’ 4.20% of the shares.

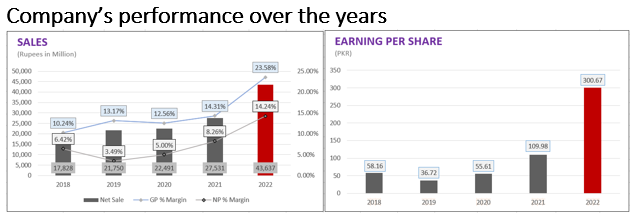

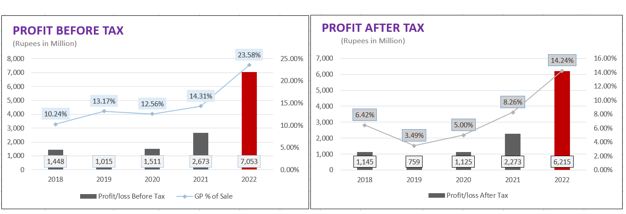

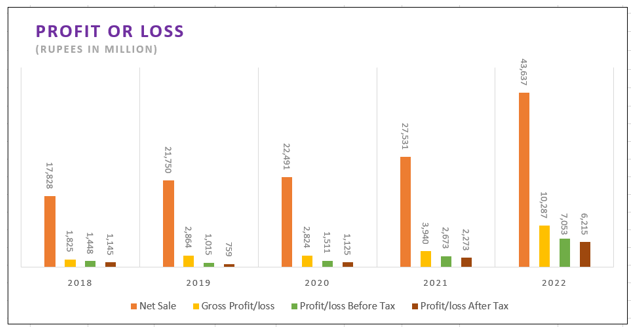

The company managed a slight increase in its revenue in 2020 as the Covid-19 pandemic slowed the economic activity. Sales revenue increased by 3.4% to Rs22.49 billion from Rs21.75 billion in 2019. As a result, the business’s gross profit remained flat at Rs2.86 billion year-over-year. However, the company’s net profit surged to Rs1.12 billion from Rs759 million in 2019, thus pushing EPS up to Rs55.61 from Rs36.72.

In 2021, the company’s top line climbed to Rs27.53 billion from Rs22.49 billion in 2020 as a result of an increase in the production and rising demand for products. Owing to the increased demand and economic recovery following the lifting of restrictions brought on by Covid-19, the gross profit increased to Rs3.94 billion from Rs2.82 billion the previous year. The net profit also jumped from Rs1.12 billion the previous year to Rs2.27 billion in 2021. As a result, the EPS jumped to Rs109.98 from Rs55.61.

In 2022, the company witnessed a record increase in its top line to Rs43.63 billion compared to Rs27.53 billion in the previous year due to an increase in the product demand. The company reported over 161% increase in gross profit during the year, which stood at Rs10.28 billion, up from Rs3.94 billion in the previous year. The net profit also jumped from Rs2.27 billion in the previous year to Rs6.21 billion in 2022. As a result, the EPS climbed to Rs300.67 from Rs109.98 in 2021.

Credit : Independent News Pakistan-WealthPk