INP-WealthPk

Ayesha Mudassar

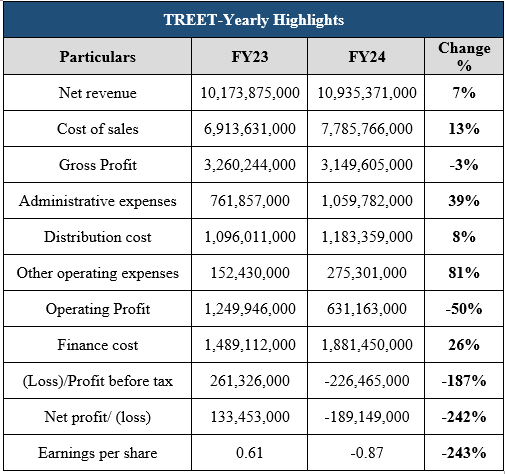

Treet Corporation Limited (TREET) experienced a significant decline in financial performance, reporting a net loss of Rs189.1 million for the fiscal year 2024, compared to the net profit of Rs133.4 million achieved in the previous fiscal year, according to WealthPK.

This shift from profitability to loss underscores the compounded effects of rising administrative and operational expenses, coupled with a substantial increase in financing costs.

According to the unconsolidated income statement, TREET posted a loss before tax of Rs226.4 million for FY24 compared to a profit of Rs261.3 million in FY23. Additionally, the company announced a loss per share of Rs0.87 for the reviewed period. The operating profit demonstrated a marked decline of 50% relative to the prior year. On a positive note, the company achieved a 7% increase in revenue, which illustrates effective strategic sales initiatives in both domestic and export markets. The fiscal year 2024 proved to be exceptionally difficult, characterized by persistent high inflation, multiple increases in energy tariffs, and an escalating tax burden on the existing taxpayer base. Furthermore, historically high borrowing costs have exacerbated the challenges faced by businesses.

Pattern of Shareholding

As of June 30, 2024, Treet Corporation has 371 million shares outstanding which are held by 12,050 shareholders.Individuals own over 43% of the company, making them the largest shareholder group, followed by the company's directors, who own 42%. The National Investment Trust (NIT) and the Investment Corporation of Pakistan (ICP) hold 5.7%, while joint stock companies hold 4.8%. Additionally, banks, development finance institutions (DFIs), and Insurance companies account for 4.8%. The remaining shares are held by other categories of shareholders including Modarba, the Federal Board of Revenue (FBR), and foreign companies.

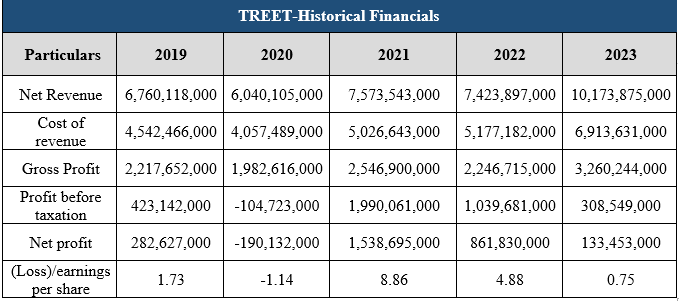

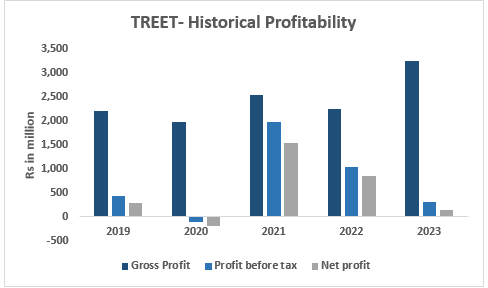

Performance over the last five years (2019-2023)

Treet Corporation's top line has generally shown growth, with the exception of the years 2020 and 2023. However, profit margins have experienced fluctuations throughout the periods analyzed. In 2020, the company's net revenue dropped by 11% on account of lower domestic and export sales. Owing to the outbreak of Covid-19, TREET experienced a reduction in its gross profit. In addition, discontinued operations contributed to a negative bottom line of Rs190.1 million in 2020. Following the decline in 2020, Treet Corporation's revenue regained momentum in 2021 and grew substantially by 25% Year-on-Year (YoY). This increase was driven by higher sales volumes, improved pricing strategies, and a favorable product mix. Consequently, the company reported a net profit of Rs1.5 billion in 2021, a significant turnaround from the loss recorded in the previous year.

In 2022, Treet Corporation experienced a slight reduction of 2% in net revenue. This decline was attributed to elevated costs and lower sales volumes, leading to an 11.8% decrease in gross profit. Nevertheless, the company posted a net profit of Rs861.8 million, with earnings per share of Rs4.88. The year 2023 saw an impressive 37% YoY growth in revenue, attributed to enhanced sales volumes across various segments and effective price optimization strategies. As a result, the gross profit jumped by 45%. However, higher salary expenses, elevated advertisement costs as well as soaring finance costs have resulted in a 44% drop in net profit compared to 2022.

About the Company

Treet Corporation was established in Pakistan on January 22, 1977, as a public limited company under the Companies Act 1913 (now Companies Act, 2017). The company's primary business activity involves the manufacturing and sale of razors and razor blades, in addition to various trading operations. Besides holding a significant share of the local market, Treet Corporation exports its products to over 40 countries worldwide.

Credit: INP-WealthPk