i INP-WEALTHPK

Azeem Ahmed Khan

Pakistan’s fisheries sector, long characterized by modest growth and underutilized potential, is beginning to show signs of revival. If properly supported, this sector can emerge as a robust contributor to economic growth, rural livelihoods, and food security, reports WealthPK.

According to the Pakistan Economic Survey 2024-25, the sector recorded a provisional growth rate of 1.42%, the highest in six years, indicating a possible shift in the sector’s direction. Historically, the fisheries sector has grown at a slow pace, with the growth rates remaining below 1% from FY2019-20 through FY2023-24. However, the 1.42% growth in FY2024-25 indicates improving resource management, increasing investment, and policy reforms beginning to take effect.

Despite this progress, this sector still contributes only 0.31% to the GDP, underscoring its underutilized economic potential. The survey underscores the sector’s crucial role in food security and livelihoods. It contributes 1.31% to the agricultural GDP and provides an essential source of alternative protein, helping to reduce the national reliance on conventional meats such as beef and poultry.

Although the survey shows the fisheries sector making an improvement after years of slow growth, it still faces some challenges, especially in exports. From July to March FY2025, the total fish production reached 798.48 million metric tonnes (mmt), comprising 590.48mmt from marine sources and 208mmt from inland waters. This reflects a 36% increase in production over the same period last year, largely fueled by a 55.3% surge in marine fishing. However, this production growth did not translate into export gains.

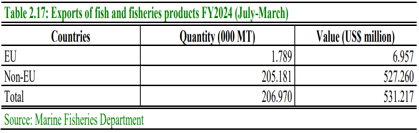

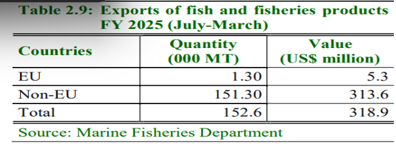

Pakistan exported 152.6 thousand metric tonnes of fish and fish products in the first nine months of FY 2025, generating $318.9 million in export earnings. This marks a significant drop of 26% in export volume and about 40% in value compared to the same period of FY2024, when exports stood at 206.97 thousand metric tonnes worth $531.28 million.

The survey shows that the export market remained heavily tilted toward non-EU countries, accounting for more than 99% of Pakistan’s fish exports. In FY2025 (July-March), non-EU exports totaled 151.30 thousand metric tonnes, earning $313.60 million. In contrast, the EU markets received only 1.30 thousand metric tonnes valued at $5.30 million.

The same trend persisted in FY2024, with the EU imports representing less than 1% of total exports despite offering higher margins. The limited access to the EU markets is attributed to stringent regulatory requirements and a lack of targeted export strategies. Experts suggested that improved compliance with the EU standards could unlock significant value and help diversify Pakistan’s fish export destinations.

This would not only reduce dependency on non-EU markets but also stabilize earnings amid shifting global trade dynamics. Looking ahead, the survey notes, while the fisheries sector's contribution to the GDP remains small, the upward trend in growth and production signals a positive shift. To sustain this momentum, analysts recommended policy continuity, investment in cold chain infrastructure, and focused efforts to meet the international quality standards, especially for accessing the high-value EU markets.

The current challenges in export performance underline the need for a balanced approach, one that emphasizes both volume and value, along with long-term sustainability and market diversification.

Credit: INP-WealthPk