i INP-WEALTHPK

Ayesha Mudassar

Pakistan Refinery Limited (PRL) plunged by 85.5% year-on-year (YoY) in its profitability, which clocked in at Rs1.82 billion in the fiscal year 2022-23 as compared to a net profit of Rs12.57 billion in FY22. The drastic drop in profit was mainly due to the challenging and adverse economic conditions that led to depletion of the country's foreign exchange reserves, depreciation of local currency, a steep increase in the interest rate, and the highest-ever inflation The cost of sales also surged by 48.83% YoY, pushing down the gross profit by a substantial 63.99% YoY to Rs7.3 billion in FY23. On the expense side, the company observed a rise in selling expenses by 55.81% YoY and other expenses by 0.42% YoY to clock in at Rs975.19 million and Rs2.44 billion, respectively, during the period under review.

Revenue and cost of crude were significantly high throughout the year (FY23) due to increased oil prices coupled with the devaluation of the rupee against the US dollar. In addition, the company persistently faced the Letter of Credit opening issues and steep surge in interest rates, which dented its profitability.

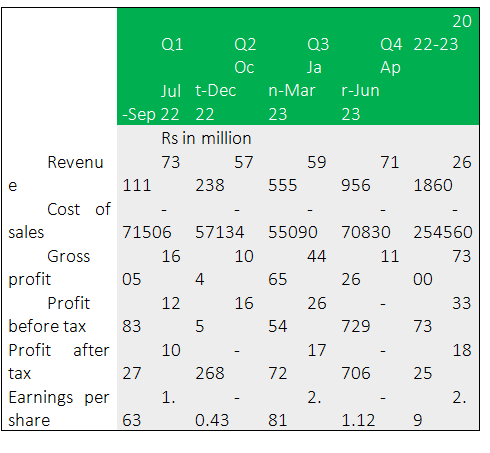

Analysis of quarterly results

The refining margins were extraordinarily high in the last quarter of FY22, which slightly trickled down in the first quarter of FY23. However, the country faced the worst floods in August 2022, significantly disrupting the oil demand country-wide. Furthermore, the refinery was shut down for 20 days for catalyst regeneration, which led to the decline in profitability. The company ensured the continuity of operations by deploying various strategies such as procurement of economically fit crudes, production of high-margin products, dynamic inventory planning, and application of cost-saving measures. As a result, the third quarter of FY23 saw better profit margins.

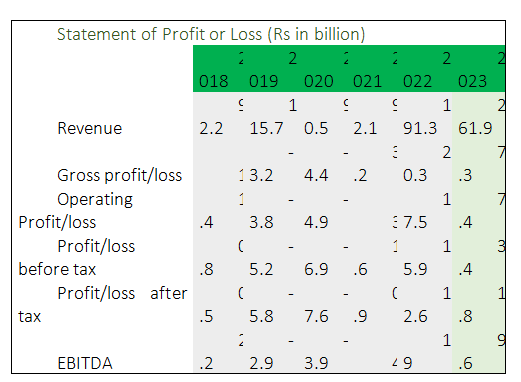

Performance over the last six years Analysis of statement of profit or loss

PRL had exceptional margins in FY22 as depicted by an operating profit of Rs17.50 billion against Rs7.45 billion in FY23.

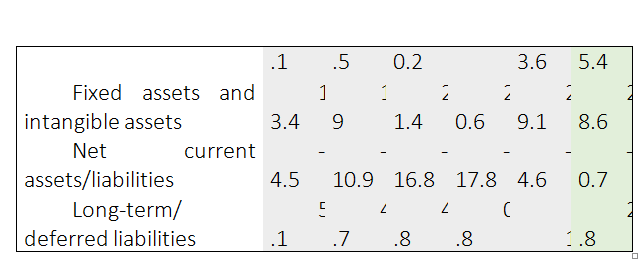

Analysis of statement of financial position

During the past six years, the company's share capital primarily remained unchanged except for right share issuance in 2020, which doubled the share capital of the company to Rs6.3 billion. The reserves of the company gradually increased over the years primarily due to profit retention. As a result, the total shareholders’ equity reached Rs25.4 billion a 6.4-fold increase since 2018.

The non-current assets increased primarily due to the revaluation of land by Rs16.3 billion over six years. The increase in current liabilities is primarily due to the increase in trade and other payables on the back of an increase in the cost of purchases due to a rise in international crude oil prices coupled with substantial devaluation of the exchange rate. Short-term borrowings also increased manifold. Long-term borrowing is the major component of non-current liabilities, which dropped to a half over six years.

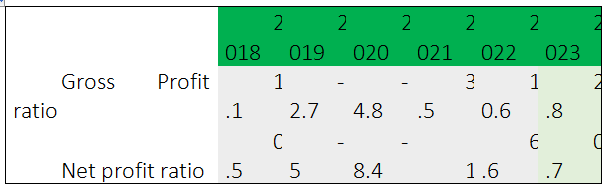

Analysis of profitability ratios

The company had exceptional margins in FY22 as depicted by a gross profit ratio of 10.6% and a net profit ratio of 6.6%. The FY23 profit was also lower than in FY22 because of extraordinarily high gross refining margins (GRMs). The GRMs were boosted by a surge in commodity prices due to global geopolitical tensions.

Company profile

PRL is a hydro-skimming refinery incorporated in Pakistan as a public limited company in May 1960. It is engaged in the production and sale of petroleum products. It operates as a subsidiary of Pakistan State Oil Company Limited, which is the largest oil marketing company in Pakistan. PRL's shares are publicly traded on the Pakistan Stock Exchange Limited. The refinery is strategically located in Karachi, with a designed throughput capacity of 50,000 barrels per day. The major units in the refinery complex are the Crude Distillation Unit, Hydrotreating Unit, Platformer Unit and Isomerisation Unit.

Credit: INP-WealthPk