i INP-WEALTHPK

Moaaz Manzoor

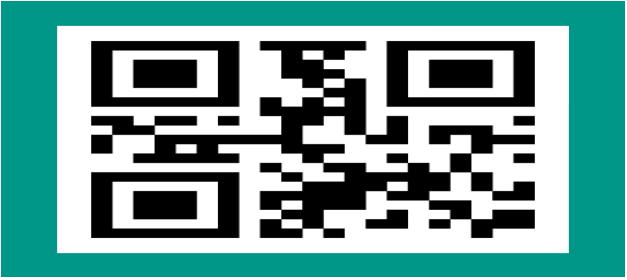

Experts believe Pakistan’s push for QR-based digital payments will not only modernise the country’s financial system but will also strengthen tax collection and broaden the base, paving the way for a stronger cashless economy.

To accelerate the adoption, the State Bank of Pakistan (SBP) has rolled out a national strategy to ensure digital payment infrastructure, including Raast QR codes, Point of Sale (POS), and Soft POS at all retail and commercial outlets nationwide. The SBP has asked provincial authorities and regulators to make sure businesses under their jurisdiction accept digital payments.

Speaking to Wealth Pakistan, Awais Ashraf, Director of Research at AKD Securities, said the adoption of Raast is expected to accelerate digitalisation, enhance economic documentation and ultimately strengthen tax collection. Industry stakeholders view the shift as part of a larger financial transformation.

Speaking to Wealth Pakistan, Fahad Sajid, Chief Executive Officer of Pakistan Fintech Network, said: “Faster digital payment adoption will boost the government revenues. We have to increase the adoption, and if we want to work on the financial inclusion, we have to give incentives to the merchants and to the end-users, our consumers.”

He explained: “Once the digital adoption is increased, it will be easier for the government to widen the tax net. So obviously it’s going to be a two-to-three-year journey. After two to three years of making things easier for the consumers, the Federal Board of Revenue and other tax collecting agencies may see better tax collection from the digital payment means. It will be much better than what they are collecting now.”

Looking ahead, Fahad stressed that the authorities and industry players should work on multiple fronts to create lucrativeness for the end-users and the merchants to use digital payments. Experts agree that the QR-based payment system is more than just a technological upgrade – it is a step towards reshaping Pakistan’s economy, ensuring financial inclusion, and widening the tax net in the years ahead.

Credit: INP-WealthPk