آئی این پی ویلتھ پی کے

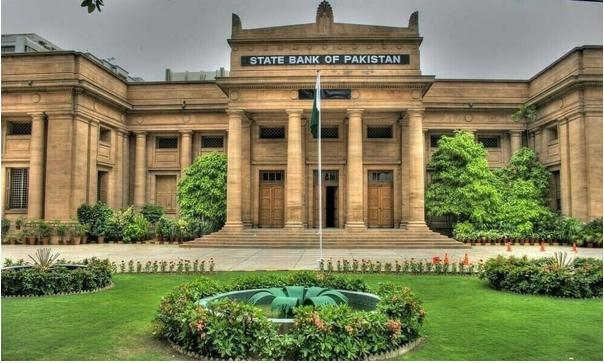

Govt cuts SBP debt by 30pc to Rs3.8tr under buyback plan

September 11, 2025

Abdul Ghani

The Government of Pakistan has reduced its outstanding debt held by the State Bank of Pakistan (SBP) by 30 percent, from Rs5,429 billion to Rs3,796 billion, according to documents available with Wealth Pakistan.

The document reveals that the government repurchased a total of Rs1,633 billion from the SBP, as well as an additional Rs1,000 billion from market investors, under its Liability Management Operations (LMO). This buyback strategy aims to optimize Pakistan’s debt profile, reduce borrowing costs, and improve the country’s overall financial stability.

A major milestone in this initiative is the upcoming maturity of Rs5,429 billion in government debt, which is due to be repaid on a single day in June 2029. To smooth the repayment burden, the government has already retired Rs500 billion in FY2025, followed by another Rs1,133 billion scheduled in FY2026.

These efforts have led to significant savings, including Rs31 billion in FY2025 and an expected Rs109 billion by the end of FY2026. With a 30 percent reduction in SBP-held government debt, the government’s fiscal position is now considerably more manageable, leaving it better equipped to face future financial challenges. This strategic move reflects Pakistan’s commitment to sound fiscal management and long-term economic stability.

A senior official from the Ministry of Finance told Wealth Pakistan that the buyback is a crucial step towards strengthening Pakistan’s fiscal position. “It reflects the government’s commitment to reducing debt-related risks and ensuring long-term financial stability. By proactively managing our debt portfolio, we are positioning the country for a more secure economic future,” he added.

Credit: INP-WealthPk