INP-WealthPk

Moaaz Manzoor

Pakistan saw inflation hitting a 44-month low in September 2024 due to a drop in the global oil prices and a stable exchange rate, boosting consumer confidence and stabilizing the spending patterns, but highlighting the need for lasting government reforms, reports WealthPK.

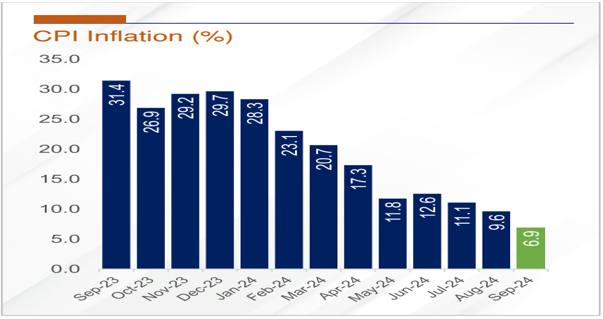

According to the October Economic Outlook Report from the Ministry of Finance, the Consumer Price Index (CPI) inflation dropped to the levels not seen since early 2021, marking a shift toward economic stabilization. For the first quarter (July-September) of FY2025, CPI inflation stood at 9.2% — a steep reduction from 29.0% during the same period last year. Year-on-year CPI inflation for September 2024 was recorded at 6.9%, a decline from 9.6% in August and well below the 31.4% observed in September 2023. Month-on-month inflation also decreased by 0.5% in September 2024, marking a positive shift from 2.0% increase during the same month last year.

Source: https://www.finance.gov.pk/economic/economic_update_October_2024.pdf

Experts attribute this decline in inflation to three main factors: falling global oil prices, a stable exchange rate, and price growth reaching its peak levels. Dr. Nasir Iqbal, Acting Dean and Head of Macro Policy Lab at the Pakistan Institute of Development Economics (PIDE), said, “Globally, the oil prices have come down, which has helped ease inflationary pressures significantly. The stable exchange rate over the past year has also played a role. However, he noted that while the inflation rate appeared to be slowing, the overall prices remained high, meaning they are still increasing but at a slower pace rather than decreasing. “Inflation essentially measures the rate at which prices grow,” he explained. “If inflation is 10%, it means the prices are 10% higher than they were a month or year ago.

We’re seeing a slowdown in the rate of price growth, not an actual drop in prices.” Dr. Iqbal also cautioned that while the lower inflation figures signal some stability, they do not reflect any major government reforms addressing price mechanisms or controlling supply and demand. According to him, the government’s current priorities are more investment-oriented and lack initiatives to curb inflation sustainably. “There’s no stable price mechanism in place, and the demand-supply adjustments are not driven by the government reforms. What we see in inflation reduction is largely a natural correction rather than policy-driven improvement,” he explained. The October Economic Outlook Report further broke down areas contributing to inflation.

Perishable food items registered a year-on-year inflation rate of 20.4%, housing, water, gas, and fuel costs contributed 20.9%, and inflation for health, clothing and footwear, and education was recorded at 13.7%, 15.5%, and 12.6% respectively. The Sensitive Price Index (SPI) showed a slight decrease of 0.22% for the week ending October 24, 2024, with prices of 13 items rising, 10 declining, and 28 remaining stable. This decline in SPI indicates some relief for the consumers, and when combined with the broader CPI trend, it offers a foundation for cautiously an optimistic consumer sentiment. Looking forward, the report anticipates that the downward trend in inflation will support Pakistan’s economic recovery. Inflation is projected to remain within a range of 6-7% in October, with a further dip expected to be 5.5-6.5% by November 2024.

The significant drop in inflation provides a positive signal for Pakistan’s economy, potentially fostering consumer confidence and stabilizing spending patterns. However, without substantive government reforms, this reprieve primarily results from external factors like global oil prices and exchange rate stability. Consequently, the inflation control may be temporary and vulnerable to the international economic fluctuations. Sustainable inflation management will require a stronger focus on demand-supply mechanisms and stable price policies. Government action in these areas is essential for long-term stability to anchor inflation and promote resilient economic growth.

Credit: INP-WealthPk