آئی این پی ویلتھ پی کے

Ayesha Mudassar

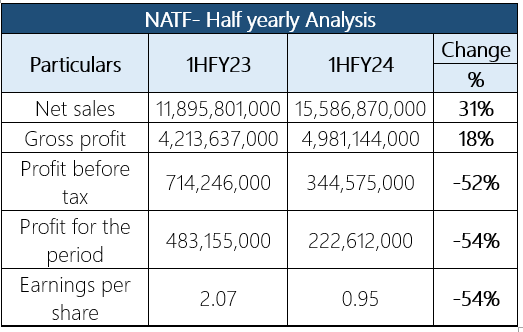

The National Foods Limited (NATF), the country's leading food manufacturer, plummeted by 52% and 54% in before and after-tax profits, respectively during the first half of the ongoing fiscal year (1HFY24) as compared to the corresponding period of the last year, according to WealthPK. As per its half-yearly report, the company posted a pre-tax profit of Rs345 million and a post-tax profit of Rs223 million in 1HFY24. The lower profit was mainly due to the strained macroeconomic conditions that included a protracted commodity super cycle, current account deficit, and high-interest rates.

The company’s net sales stood at Rs15.5 billion in 1HFY24 as compared to Rs11.8 billion in 1HFY23, representing a 31% increase. Furthermore, the cost of sales also surged by 38% during the period under review. On the expense side, distribution and administrative costs rose by 12% and 47%, respectively, signifying high inflation and soaring freight charges. In addition, the finance costs posted a jump of 163% year-on-year (YoY) in 1HFY24 due to the higher gearing for the strategic investments in the Faisalabad production facility.

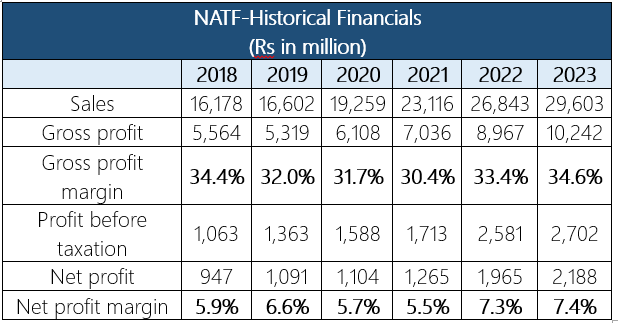

Six years at a glance ((2018-2023)

Financial performance

Despite adverse economic conditions, the company has consistently improved its financial performance since 2018 as evidenced by the constant rise of its top line and bottom line. Notably, the company’s margins have followed a cyclical pattern. After a three-year decline, the gross margin reverberated in 2022, reaching its peak in 2023. Conversely, the net profit margins initially increased in 2019, declined in 2020 and 2021, and have since shown signs of recovery. In 2019, NATF's top line posted a marginal 3% rise. However, a rise in inflation and depreciation of the rupee resulted in a 4% reduction in gross profit, with GP margin falling from 34.4% in 2018 to 32.0% in 2019. Net profit stood at Rs1,091 million in 2019 with an EPS of Rs7.31.

In 2020, the company posted a moderate 16% YoY growth in its net sales. The gross profit grew by 15% YoY in 2020; however, the GP margin posted a down stick to clock in at 31.7%. The net profit for the year stood at Rs1,104 million with an NP margin of 5.7 %. The year 2021 fetched a 20% YoY rise in the top line of the company. The growth is mainly attributed to the resumption of business activities after Covid-19. This translated into a 15% YoY rise in gross profit, which stood at Rs7,036 million in 2021 with a GP margin of 30.4%. Despite countless economic challenges, the company's top line continued to post a 16% YoY escalation in 2022. The growth was primarily driven by portfolio rationalization, price revisions, and exchange gains on export sales.

The company's cost transformation measures along with strategic buying decisions led to a 27% rise in gross profit. The bottom line posted a 55% YoY growth to clock in at Rs1,965 million with an NP margin of 7.3%. The company registered a 10% YoY growth in its net sales in 2023. The growth was mainly led by price revisions to counter high inflation, raised cost of borrowings, Pak Rupee depreciation, and a steep hike in energy costs. Furthermore, the gross profit rose by 14% in the year with GP margin touching its peak level of 34.6%. The net profit rose by 11% YoY to clock in at Rs 2,188 million in 2023 with an NP margin of 7.4%

Company description

National Foods was incorporated in Pakistan on February 19, 1970 as a private limited company under the Companies Act 1913. It was subsequently converted into a public limited company under the Companies Ordinance, 1984 (now Companies Act 2017). The company is principally engaged in the manufacture and sale of a wide range of food products including pickles, ketchup, and desserts.

Recent event

The company has established its first overseas manufacturing facility in Sharjah, the United Arab Emirates (UAE), to increase its global footprint and boost exports of edible goods.

Credit: INP-WealthPk